Warehouse Tech Scene Gets Crowded

650 companies shaping warehouse automation while vying for its $30B payoff

The year 2020, with its economy-crushing COVID pandemic, liberally sprinkled with lots and lots of uncertainty, has cast a mega-spotlight on the use of automation in warehouses worldwide. Whether logistics is adapting to new social distancing rules, or under pressure to distribute a higher volume of essential goods, or struggling to meet same day delivery or even trying to add more remote work capabilities, the rapid churn of SKUs through warehouses is without precedent.

It’s completely changing what it means to move and store goods from one place to another.

For a few years now the armies of warehouse transformation have been massing and now seem more than ready to completely automate the global face of logistics.

The good folks at LogisticsIQ have put together a stellar look at what’s happening in their latest post-pandemic market research study, Warehouse Automation Market. The bottom line: It will reach a milestone of $30B by 2026, at a CAGR of ~14% between 2020 and 2026.

What’s happening

Despite of the temporary reduction in retail and e-commerce caused by lockdown and economic distress in this pandemic, we have seen a strong order intake of warehouse automation in 2020 which may reflect in revenues of these system integrators and manufacturers in 2021 or 2022.

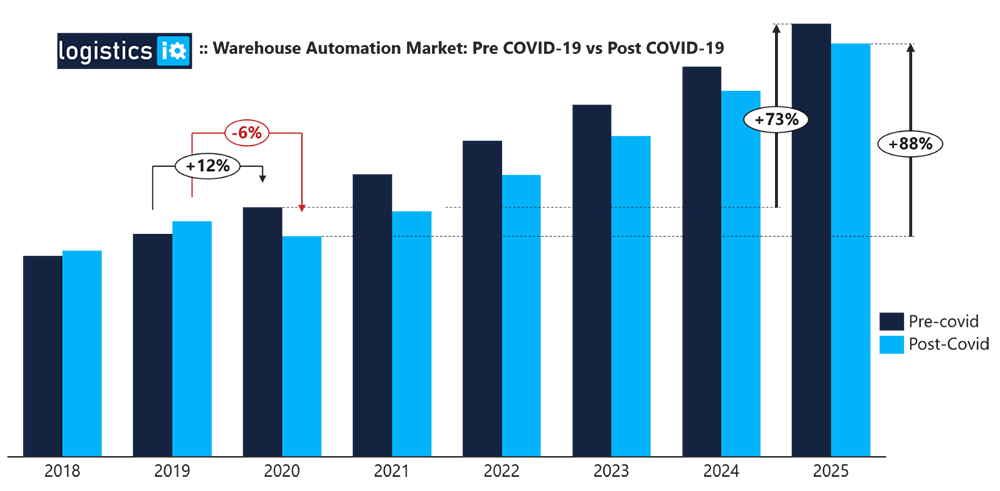

At the same time, a revenue dip of 6% is expected in 2020 as compared to our pre-pandemic forecast of 12% growth because projects were put on hold due to supply chain disruption and COVID locked down guidelines.

It has also increased the order backlog at a record level for warehouse automation players.

Of course, the push to automate warehouses was in full force before the COVID, but the global pandemic forced companies to change their strategy with respect to warehouse automation from “good to have” category to “must to have” if they have to sustain in this industry.

One of the learnings from the COVID pandemic is that mega-trends like aging population, globalization, health & safety, mobility, green logistics, autonomous world, urbanization, individualization and digitization need to be given more consideration and weight than in the past with a long-term vision so that we are ready with any challenge.

The growth of this market can be attributed to the growth in the e-commerce industry, multichannel distribution channels, globalization of supply chain networks, emergence of autonomous mobile robots and rising need for same day delivery.

$5T global logistics industry

The boom in e-commerce is compounding the major labor challenges faced by the $5T global logistics industry. Not only are shipment volumes growing rapidly, but online retail also typically requires more logistical work per item than brick & mortar retail. Indeed, online purchases require individual picking packing and shipping, as opposed to the bulk transportation models of traditional brick & mortar retail.

Post COVID, most important and emerging trends have been eGrocery growth, Micro-Fulfillment Centers, Urban Warehouses and automated cold storages.

Huge investment for start-ups like Takeoff technologies ($86M+), Fabric ($136M+), Attabotics ($82M+), Exotec Solutions ($111M+) and Alert Innovation are witnessing this growth along with presence of existing players like Dematic, Swisslog, Knapp, Opex Corporation, Muratec, AutoStore, Honeywell Intelligrated and Toyota Industries. Retailers such as Walmart, Kroger, Woolworth, Amazon, Ocado, Meijer, H-E-B, Albertsons, and Ahold Delhaize have already started adopting and implementing these new technologies during pandemic. Apart this, piece picking players like Berkshire Grey, Righthand Robotics, Kindred AI, Covariant, OSARO, Plus One Robotics, XYZ Robotics have established a new attractive capability for order picking in ecommerce fulfillment.

Analytical Insights

- Among all regions, US has been the key region to target having more than $4B market size in 2019 with a growth rate of 12% in next 5 years. Germany is the traditional hub in Europe apart having ~35% market share in the region apart from some attractive markets like UK, Nordic region and France. It is expected that next wave of opportunity is going to be originated from South East Asia, India & Australia which are the key market in APAC after China, Japan and South Korea. This group (SEA) of 10 countries is leading the adoption of robotics automation to match the GDP growth of around 5% but pandemic has put down this growth in short term.

- AGV/AMR market is expected to cross $5B mark by 2026 with a CAGR of ~32%. AMR (without any external support of optical tape, sensor or vision) is going to be main contributor in retail warehouses due to high demand in e-commerce sector and its flexibility to deploy the robot without any major change in the existing warehouse infrastructure. However, it is a bit slow in terms of pick rate per hour as compared to ASRS but is preferred in small and medium warehouses due to lower cost and quick deployment. It is expected that AGVs/AMRs are going to have more than 18% market share by 2026 in overall warehouse automation market led by AMR players like Geek+, Grey Orange, HikRobot, Locus Robotics, Fetch Robotics, Shopify (6 River Systems), Teradyne (MiR, AutoGuide Mobile Robots), Quicktron etc.

- The Grocery industry is one of the most challenging and attractive industries from a logistics perspective. Grocery distributors ship high cubic volumes of merchandise to retail stores with frequent deliveries to ensure product freshness. Grocery distribution center operations are amongst the most labour intensive of any industry. Higher automation driven by online grocery, micro-fulfillment centers and COVID is going to be biggest opportunity in next 2-3 years led by cube ASRS, Delivery Robots and Micro-Fulfillment players such as AutoStore, Takeoff Technologies, Exotec, Fabric, Attabotics, Dematic, Nuro, Tele Retail, KiwiBot, Robby Technologies, and Starship. Automation for eGRocery is going to witness an opportunity worth ~$5B by 2026 with ~18% growth rate. Kroger has already partnered with Ocado to bring its stores and supply chain to deliver best-in-class service to its customers. The first phase of the plan involves building 20 automated customer fulfillment centers across the United States to modernize and streamline operations.

Key highlights

- Warehouse automation equipment suppliers and industry consultants expect broadly double-digit growth in sales driven by demographic changes, increased penetration in e-commerce and the advent of the Industrial IoT, that will drive demand for data analytics and automated operations, especially after COVID.

- Competitive landscape – There are 10 large and 10-20 medium-size companies operating in the material handling equipment space capable of delivering comprehensive automated warehouse solutions. Top 10 large companies (including Dematic, Daifuku, SSI-Schaefer, Honeywell Intelligrated, Knapp, Toyota, Muratec, Swisslog) are capturing more than 50% of market share although lots of start-ups are emerging in new categories like AMRs, Picking Robots, Micro-Fulfillment, Autonomy Service Providers etc.

- Service model importance increasing – Over the time as the installed base of automated warehouse solutions grows, industry players expect an increase in revenues from services and maintenance, which would have a positive impact on profitability as the service business typically has 15-20% operating margins, versus 3-5% margins for new equipment. It is expected to be ~$7B worth market by 2026.

- Business models are also changing considering the real time pain points of end-users for high capex. Businesses are increasingly intrigued with RaaS because of its flexibility, scalability, and lower cost of entry than traditional robotics programs. The business model for picker-as-a-service is usually on a per-pick basis, ranging from 6 cents to 10 cents per pick, while AMR-as-a-service is usually leased on a monthly basis, from US$711 per robot per month to several thousands of dollars per month, depending on the commitment period.

- Industry Consolidation – The past 3-4 years have seen an increase in consolidation amongst material handling equipment providers as traditional players see acquisition of technology leaders as an increasingly attractive way of positioning themselves in response to changing market trends. Acquisitions like KION (Dematic), KUKA (Swisslog), Toyota (Vanderlande, Bastian Solutions), Hitachi (JR Automation), Honeywell (Intelligrated, Transnorm), Korber (Cohesio Group), Teradyne (MiR, Energid, AutoGuide Mobile Robots) are just some of the examples of this consolidation.

Facts to know

- Global e-Commerce sales have grown at a CAGR of 20% over the last decade, reaching ~$3.5 trillion worldwide in 2019 and expected to grow to ~$7.5 trillion by 2026. The share of online retail sales has gone from ~2% of total to ~13%, and is further expected to reach ~22% by 2026

- Existing fully automated systems can reduce warehouse related labour costs by up to 65% and logistics-related spatial use by up to 60% at the same time as it increases the maximum output capacity.

- The adoption of technology is by no means uniform. While one-hour delivery is available when buying online in some parts of the U.S. and Europe, the average promised delivery time in Brazil is nine days. JD.com had a record-breaking Singles Day in 2019, with transaction volume exceeding CNY204 bn (US$29 bn), up by 27.9% on the previous year. Logistics played an important role, with 90% of areas achieving same-or next day delivery and 108% YOY increase in number of orders fulfilled by automated warehouses.

- Amazon Robotics automates the company’s fulfillment centers using more than 200,000 autonomous mobile robots, up more than 600% from 30,000 at the end of 2015. Last year, DHL announced an investment of $300 million to modernize 60% of it warehouses in North America with IoT and autonomous robots. Company also committed a deployment of 1,000 LocusBots for delivery fulfillment. The funds are earmarked to bring emerging technology to 350 of DHL Supply Chain’s 430 operating sites.

- Warehouse labour shortages are also an issue with peak labour demands occurring around major shopping holidays viz. Black Friday, Cyber Monday, Amazon Prime day, Thanksgiving Day and Singles Day. Warehouses have to hire temporary labour around these peak times to meet the customer delivery schedules. Supply chain robotics company Cainiao has installed 700 robots at China’s largest robot-run warehouse to process orders on Singles Day.

Compare and contrast: Here’s pre-COVID outlook from 2018-2019

LogisticsIQ’s post-pandemic version of Warehouse Automation Market report is having a detailed market analysis of more than 650+ players (part of our exclusive Market Map), 10 solutions, 7 industries and 30 countries along with 440 pages, 355 Market Tables, 210 Exhibits and 110 Company Profiles. Analysis is validated through 100+ in-depth interviews across the value chain with components and technology providers, system integrators & manufacturers and end-user industry verticals.

Take a look at the 650 companies vying for a share of warehouse automation: