Elbowing to Success the Sun Tzu Way

Making Room at the Cobot Table

No better time to joust with cobot leader Universal Robots for customer attention, brand recognition, and, of course, sales

While cobot titan Universal Robots (UR) is stalled…and sliding downward in sales,

there’s no better time to joust with UR for customer attention, brand recognition, and, of course, sales.

While opportunity smiles, go for it! Especially in Asia!”

机会微笑: Opportunity smiles

If this was 512 BC, scouts for Sun Tzu would be hurriedly riding back into camp with broad grins on their faces.

They would be bearing good news for their general. The scouts would report that the invading horde from the north was stopped dead in its tracks.

Even more telling, the horde’s leader had been overheard briefing his troops: “Our industrial automation business saw a decline in Q1, which we expect will deepen in Q2 as Europe and North American manufacturing remains impacted by shutdowns.”

Sun Tzu, raising his face to the heavens would shout: “机会微笑! (Opportunity smiles!).

A Sun Tzu moment had suddenly and unexpectedly arrived, and it was time to take advantage of good fortune.

Of course, the “invading horde from the north” is none other than Universal Robots (UR), subsidiary of Teradyne; and the quote from the horde’s leader was heard at the Teradyne earnings call in late April.

NB: That was not decline and recover; that was a decline that will deepen.

And you can’t just totally blame COVID. Teradyne’s sales of its electronics test gear for 5G, 6G, and complex smartphones, although hard fought, were up…and exceeded guidance. However, Teradyne’s Industrial Automation group (UR, MiR, Energid, and AutoGuide) were not. Automotive, a big part of UR, was already down in cobot sales prior to COVID.

A Sun Tzu moment has unexpectedly arrived for cobotics. While cobot titan, Universal Robots (UR), is stalled…and sliding downward in sales, there’s no better time to joust with UR for customer attention, brand recognition, and, of course, sales. While opportunity smiles, go for it. Especially in Asia, which is UR’s primary target for 2020 and beyond.

Lagging way behind

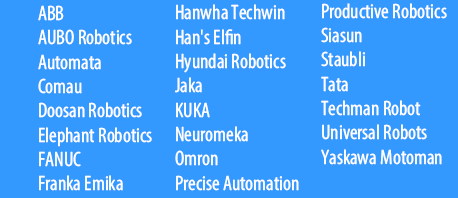

So who are these also-rans laboring to get a toehold in a cobot industry massively dominated by UR (some 45 percent of all cobot sales)? There are more than 40 cobot vendors. Here are the most notable two dozen:

See them all: Cobotics World catalog of 150 cobots

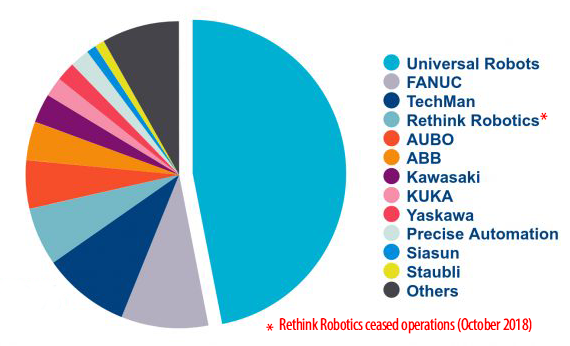

A pie chart with cobot sales looks mighty lopsided:

The sales laggards are not without merit. Some have superb cobot gear, most all have very saleable gear, notable engineering and wonderful design.

The rap on most of the small cobot vendors is that they have overlooked marketing completely. Some prefer to exhibit at trade shows only (ostensibly to save money), which are the exact places where their potential customers are no-shows: SMEs don’t go to trade shows (especially in Asia), while the big buyers in attendance are overly wary of the newbie developers behind many cobot brands.

It’s reported that the biggies like FANUC, KUKA, and ABB, etc., that actually have a cobot to sell, are inept at making onesie-twosie sales to SMEs (who aren’t even at the trade shows anyway). Big-company sales forces are said to want big-company sales only, like KUKA’s recent sale of 5,000 robots to BMW.

The facts are that cobots have been around for a decade, most SMEs who could use one or two aren’t even aware of them, and all cobots, Universal Robots included, represent barely four percent of total robot sales annually.

With the downturn in auto and auto part sales, then electronics, followed by the global COVID shut down, cobot marketing budgets evaporated as the cobot vendors took cover en masse in the Alamo. They’re still there, which is the wrong Sun Tzu place to be when opportunity smiles. Post-COVID fewer will exit the Alamo. Some maybe hope to be acquired like ABB scooping up Gomtec’s arm. Others, well, are going to let events sweep them away in silence.

Taking on UR

For those willing to contend, there are a few “filters” to consider while preparing for the joust with UR:

- As UR’s president Jürgen von Hollen has said: Cobot is not a household name with many. Barely 10 percent of the addressable market knows anything about cobots.

- Given such relative obscurity, UR’s product is by far the most well-known and best-selling cobot worldwide (the plus side of 50k total since 2008). Of the also-rans, Techman has sold about 10k cobots and Doosan 2k.

- It’s also good to keep in mind that industrial robots are selling at an annual clip that’s approaching 500k. That’s YEARLY! Yes, cobots are very recent and basically unknown…but oh what a tasty future is set out ahead of them. Both of which opportunities are not lost on Sun Tzu.

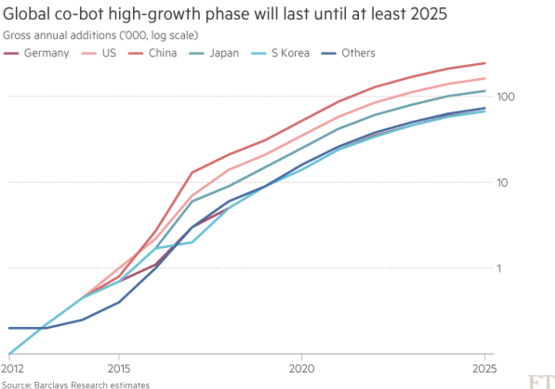

Minuscule to mighty

Overall cobot sales are miniscule. In a world that the International Federation of Robotics says consumes 400k industrial robots annually, cobots represent barely 4 percent of that number.

But…given that smallish, semi-obscure presence on the world stage, forecasts are for billions of dollars in future sales. ABI Research (pre-COVID), for example, is forecasting cobot sales to go from $711 million in 2019 to reach $11.8 billion by 2030.” According to UR, $248 million of 2019’s cobot revenue was theirs. If the average price of a UR5 cobot is $35k, UR sold approximately 7,000 cobots in 2019; or, about 35 percent of all cobot sales.

“Where industrial robots are big heavy pieces of machinery with sealed drives that might work for decades, cobots are lightweight with aluminum arms and joints powered by less robust harmonic drives,” writes David Greenfield in Automation World.

“In Universal Robots machines, those drives are designed for a minimum lifespan of 35,000 hours. That’s about four and a half years of continuous operation which equates to many more years of use in real world applications like machine tending.

“The company has robots that have been in service for more than 10 years. For high load applications, it quotes five to six years before a joint might need to be replaced.”

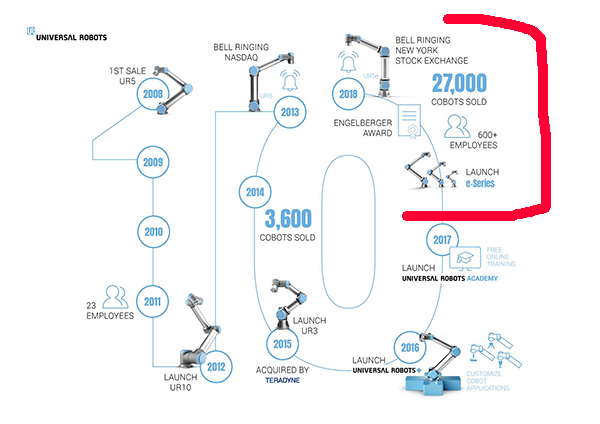

The opportunity for UR competitors that Greenfield writes about materialized in 2018, as can be seen in this UR infographic:

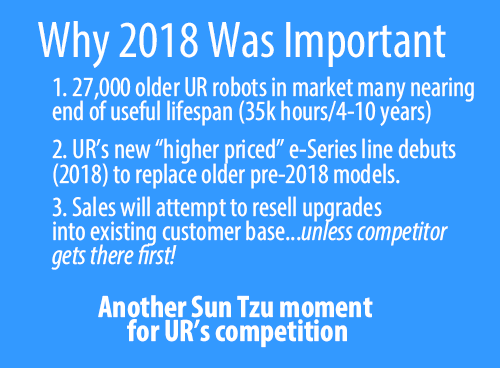

What’s so special? Well, this:

Then there are these hints:

Excerpts from:

Teradyne Q1 2020 Earnings Call Transcript

April 22, 2020

Our industrial automation business saw a decline in Q1, which we expect will deepen in Q2 as Europe and North American manufacturing remains impacted by shutdowns.

Contraction of our industrial automation businesses due to both weaknesses in the auto industry and COVID-19.

Industrial automation or IA revenue of $60 million was down year-over-year on manufacturing weakness amplified by the COVID-19 pandemic. In March, we did see some improvement in China, our fastest growing market in 2019, which is an encouraging sign and hopefully a leading indicator for countries who get back toward pre-COVID-19 work environments.

Industrial automation had some weakness building up to COVID-19 in the auto industry, which is a large part of the business. And with the rolling shutdowns in manufacturing in the US and Europe are predominantly big regions for the business.

We’re seeing that impact and obviously contract year-on-year. We did see some encouraging demand in China in the last couple of weeks of March as well as April to-date. We are seeing demand pick-up back to pre-COVID levels and it’s an encouraging sign as an indicator of how things might return back to normal, but we’re still in the early innings on that.

Our fixed cost as a percentage of the businesses is much higher because we do internal manufacturing. And so we do outsource some sub-components but fundamentally we inherently have a higher fixed cost structure just because we believe we have a leadership position and that’s one of our attributes to hold on to that leadership position. So there is a higher fixed cost component.

The second comment is in 2019 we were profitable, we had plans even though it was a heavy investment year that we’ve kind of redacted down tied to revenue. We believe we would have a profitable year. In the first quarter with the contraction, we weren’t profitable.

So, really we’re predicting a downward bias in Q2 just given the fact that there’s a lot of filter in place, manufacturing locations are still down. And so we do see a further contraction.

Looking forward as I said earlier, we did see signs of improvement what I would call getting back to an initial innings in China pre-COVID levels, but it’s really too early to tell how fast the recovery would be. And we did enter in the last quarter a little bit of weakness with automotive.

THE UPSHOT FROM THAT 10K IS THAT TIMES ARE TOUGH ALL AROUND, BUT THE TIMES ARE ALSO RIPE FOR A COBOT BREAKOUT.

WHO’S GOING TO TAKE A SHOT?

What about Hyundai

Here’s an intriguing new look at selling cobot gear.

Hyundai has a new cobot (YL012) in the marketplace, and it’s pretty good. What if Hyundai chose to sell its cobots through its auto dealerships? Like maybe two cobots on display per showroom.

Hyundai Motors operates in 192 countries and has over 5,000 showrooms worldwide. That’s a lot of selling space, and familiar space for any SME.

Every TV station in the world would do a piece on that newsworthy selling event. That’s millions of dollars in free advertising.

Sun Tzu would probably like that a lot.

What If Toyota Made Cobots…by the Millions!?

Cobot manufacturers have a looming problem: Capacity. Is cobot disruption nearby because of it?