The Gripper Chronicles

The Rise of OnRobot in an Age of Grippers

Gripper newcomer, OnRobot, building powerhouse lineup of cobot tools for “collaborative applications”

Robotic arms will become commodities and end-of-arm devices will control the whole system.”

—Martin Hägele, Head, Robotics and Assistive Systems, Fraunhofer IPA

Why not?

OnRobot, the youthful Danish gripper manufacturer, has come a long way in a very short period of time, and the company’s management wants more. OnRobot is unabashedly hellbent on becoming a world leader in grippers for cobots (a/k/a end-of-arm tooling, or EOATs). By the looks of the newbie’s aggressive business and tech moves over the past 18 months, OnRobot is getting damn close to having a good shot at pulling it off.

The boldness starts at the top with CEO Enrico Krog Iversen’s vision for rapid growth: “The aim is to build a world-leading organization in development and production of end-of-arm tooling,” he says. “We expect to reach revenue exceeding one hundred million dollars in a few years…and be fifty times larger in five years.”

That’s definitely a bold prediction.

Some may cast it as a bit over the top, but even a quick look at the rapidly expanding gripper market shows that such lofty aspirations are attainable. According to Technavio, as well as most other credible research, the gripper market is forecast to more than double over a relatively short period of time: from $855 million in 2017 to north of $2 billion by 2023 to 2025 (see chart ).

Although there are some 30-plus gripper manufacturers, Rise Media has these Top 20 with the most market share (alpha order): Afag, Camozzi, Destaco, Festo, Gimatic, HIWIN, IAI, IBG Automation, Parker Hannifin, PHD, Robotiq, Schmalz, SCHUNK, Sichuan Dongju, SMAC, SMC, Yamaha Motor, Zimmer. All of which, like Iversen, see the rise in gripper sales following closely behind the meteoric rise in cobot sales.

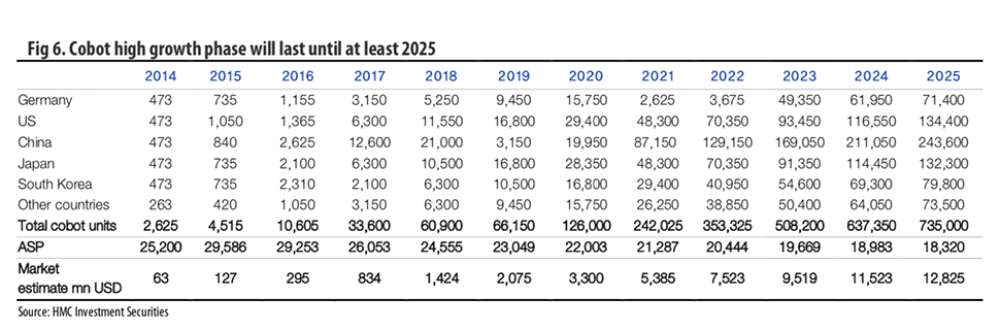

With the sales of cobots forecast to catapult to an amazing 735k by 2025 (see chart), and with every one of those cobots needing a gripper to be of any use for any job, Iversen rightly sees a huge upside for potential sales.

Can OnRobot grab off a large slice of that near-term pie chart?

Iversen has been there before. From 2008 to 2015, he was CEO of Universal Robots (UR), the originator of the industry’s first cobot arm and by far the top selling cobot worldwide. He took over at UR when the company couldn’t pay its telephone bill, and in seven years made the three UR founders each a millionaire; culminating in 2015 with UR’s acquisition by U.S.-based Teradyne for a whopping $285 million.

Can lightning strike twice for Iversen?

From three + two more make one

In 2015, Iversen, using his own money, together with Vaekstfonden (The Danish Growth Fund, a state investment fund), invested in On Robot (notice the two-word spelling); a newbie gripper startup founded by ex-UR staffers.

By 2018, Iversen was announcing the merger of his On Robot with two other end-of-arm tooling companies—U.S.-based Perception Robotics, and Hungary-based OptoForce—to form OnRobot A/S (notice the one-word spelling). With more Vaekstfonden money, plus even more from VC investor Summit Partners (deal specifics unreleased), OnRobot found itself wealthy enough to develop its software and gripper tech, and to make a formidable sales presence on a global scale.

It also had enough financial room in the till to acquire yet another Danish end-of-arm toolmaking newbie, Purple Robotics (founded in 2017, also by ex-UR staffers); and then again in 2019, OnRobot acquired yet another Danish company, Preben Hjørnet’s Blue Workforce, along with its Ragnar Robot.

Growth through acquisition has propelled Iversen’s new OnRobot A/S into an enviable market position of having top-flight gripper tech with a variety of gear for most any application.

And he says he’s not getting off the acquisition hunt any time soon. He’s got his eye on other compatible tech. Soft grippers and micro grippers, currently absent from the OnRobot roster, might be next. Or, maybe edge computing and AI are on his shopping list if “smart” grippers—the next logical step in gripper tech—are part of the OnRobot plan.

From collaborative robots to collaborative applications

One thing for sure with the OnRobot plan is to become the cobot standard for industrial automation. “The overall strategy and goal of OnRobot is to facilitate the transition from collaborative robots to collaborative applications,” he said in an interview with Control Engineering Polska. “The robots themselves will soon become commodities and we are starting to see that already as more competitors come on to the market. So basically, if you really want to add value, what is important is how you deploy the robots, what you put on the robots, and what you put around the robots.

See also: Gripper Sales to Skyrocket

“To put it simply,” he said, “if the robot is your arm the strategy of OnRobot is to be your hand, your eyes, your ears, your sensing capability, whatever makes your arm do anything. Your arm itself does not do much. We are looking at not just hardware in the form of cobots, but also the software that manages these machines.

“Software is the largest R&D division at OnRobot and I think that it will continue. Not only for the physical grippers and sensors and so on, but also for the purpose of developing a uniform user interface. …We want to be ‘robot independent’” he added.

The company’s most recent product announcements close in on Iversen’s “uniform user interface”: “the Digital I/O Converter Kit and Quick Changer—which together with other [end-of-arm tooling], creates a unique One-System Solution that dramatically simplifies automation.”

“This integration of our Quick Changer across our current product lineup,” explains Iversen, “makes it easier than ever to switch between tools and robot types, allowing flexibility and reducing downtime for more efficient production and faster automation ROI. This brings us another step closer to a unified OnRobot one-system solution that makes it easy, fast and cost-effective for manufacturers to build collaborative applications, no matter which robots they choose.”

“No matter which robots they choose” is a magical statement for any SME’s ears; it frees the buyer to choose among any cobot brand or offering, safe in the knowledge that across a vendor’s entire gripper lineup that everything fits and works fine.

The age of grippers is here with a crowded field of highly competitive tech. Gripper technology has never been so rich, varied, and full of potential. Where it will go will be exciting to watch, and The Gripper Chronicles will be sure to be there and to share all of the highlights in our special gripper column.

OnRobot is betting that it’s on a winning trajectory to capture a significant share of that $2-plus billion market. It will be interesting to see what this emerging powerhouse will do next.